On 31 August 2012, the Supreme Court of India (SC) handed down a historic verdict asking two Sahara companies to refund over Rs20,000 crore to investors that was illegally raised through quasi-debentures without regulatory clearance. High drama continued even after the verdict with the Court enhancing Sahara’s repayment to Rs25,700 crore in 2015. Subrata Roy also spent over two years in jail for contempt of court. He remains out on bail. The Court directed the Securities and Exchange Board of India (SEBI) to identify investors of the two Sahara realty firms and refund the money under the supervision of justice BN Agrawal, a retired Supreme Court judge. That was nine years ago!

In February 2020, the minister of state for finance told parliament that the Sahara group has deposited only Rs15,448.67 crore with the ‘Sebi-Sahara Refund’ account, of which it has been able to refund only Rs109.86 crore to 14,146 applicants who came forward with legitimate documents. Since then, it has paid out a little more.

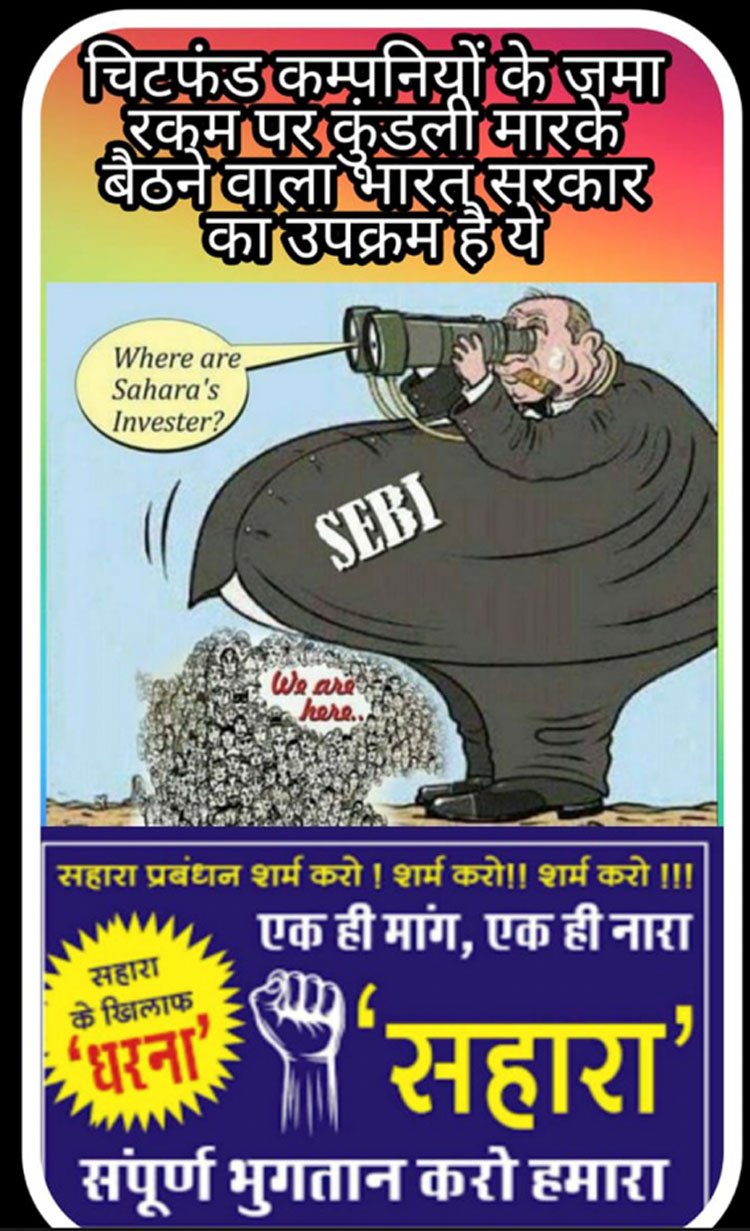

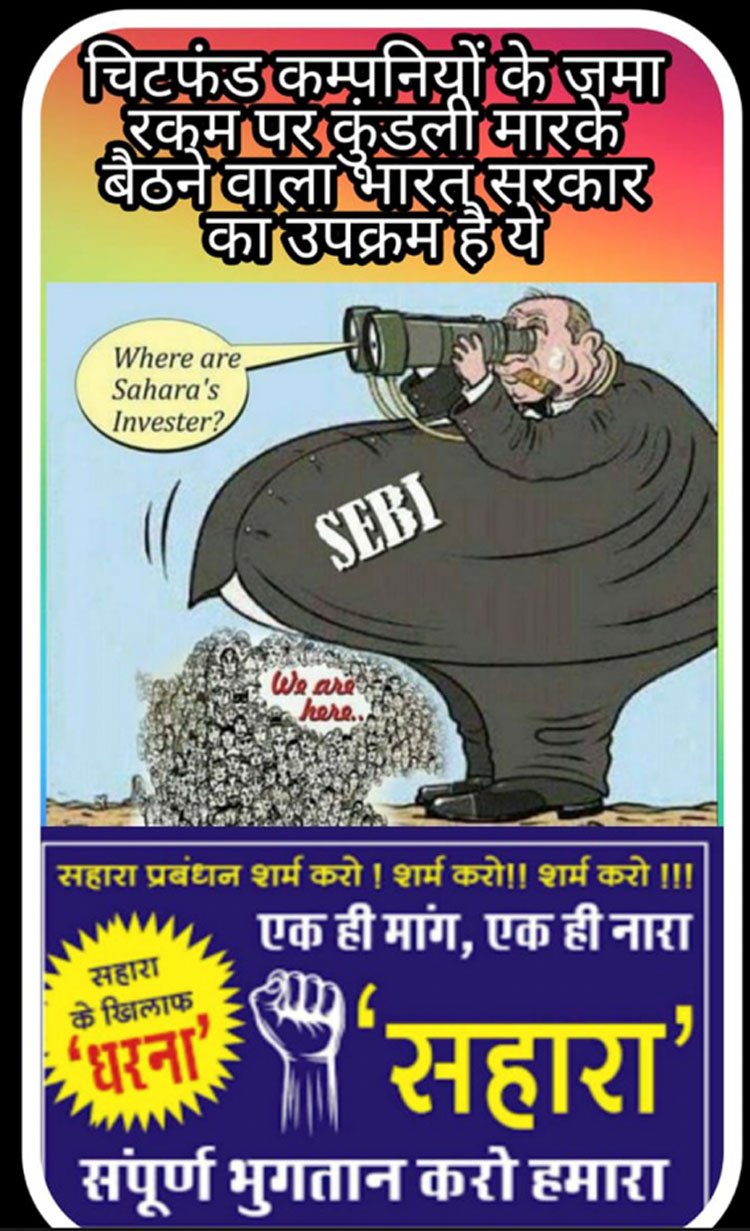

While SEBI cannot find investors of the realty companies, lakhs of genuine investors are coming forward from all over the country demanding payment. They were lured to invest in the controversial group through four giant cooperative societies spread across India. Many have a genuine claim to the money collected by SEBI, but the regulator is sticking to a narrow definition of what the Supreme Court has ordered and making no effort to help investors who were duped. Sahara investors are holding protests across India, through social media (#JusticeForSaharaInvestors) and some have even ended their lives in desperation. Innumerable police complaints have been filed all over the country; but Sahara is not making any payments.

Surely, it was never the SC’s intention that SEBI would sit over investors’ funds for a decade while complaints mount and an equitable solution needs to be found?

The plight of lakhs of investors spilled into the public domain in September 2020 through an explosive letter by Vivek Aggarwal, central registrar of cooperative societies (CRCS) who said that the group had raised a stupendous Rs86,673 crore over 10 years (from 2010) from around eight crore depositors and was unable to repay them. The money was raised through four multi-state cooperative societies registered across India—Sahara Credit Cooperative Society Ltd, the Saharayn Universal Multipurpose Coop Society Ltd, the Humara India Credit Coop Society Ltd and the Stars Multipurpose Cooperative Society. Mr Aggarwal had called for an investigation by the serious frauds investigation office (SFIO). (Read here: Sahara’s Mysterious Riches: Rs1,10,000 Crore Raised in 10 Years despite Intense Scrutiny of Government, Supreme Court and SEBI)

Many investors approached Moneylife after our articles in October 2020 (Read: Sahara Pariwar: Mysterious Riches, Tall Claims and Struggle To Repay). Moneylife Foundation, our not-for-profit organisation, collated and verified information from over 400 investors based on Sahara’s promise to pay. But the group paid only Rs39 lakh to 18 investors and then reneged on its commitment.

Moneylife Foundation Appeal to SEBI in January 2021

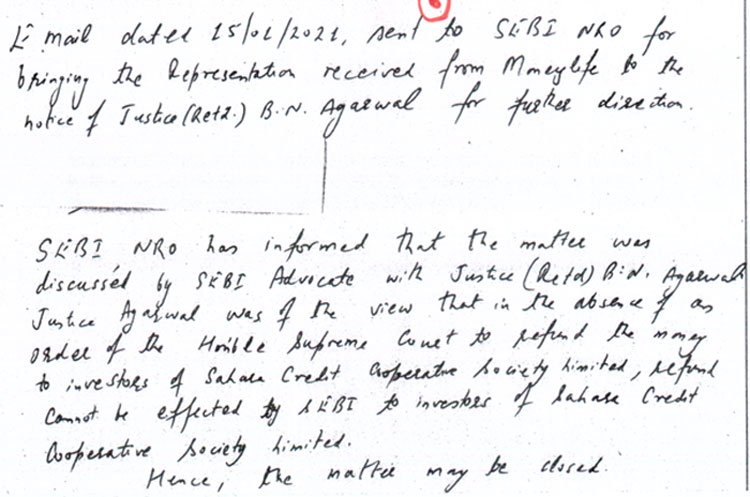

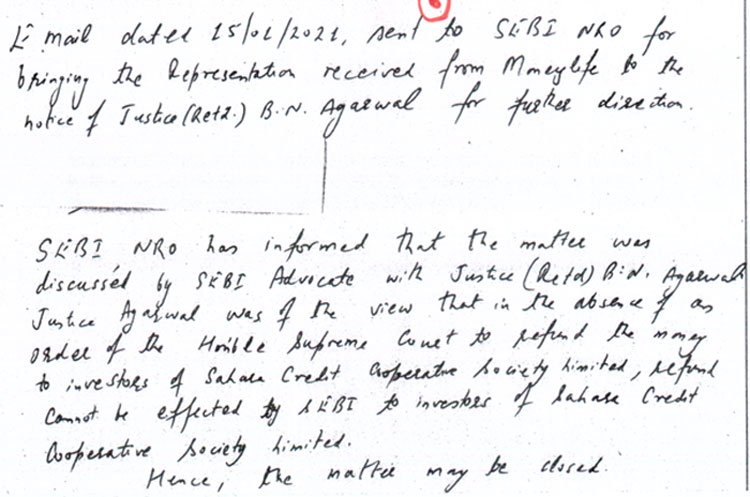

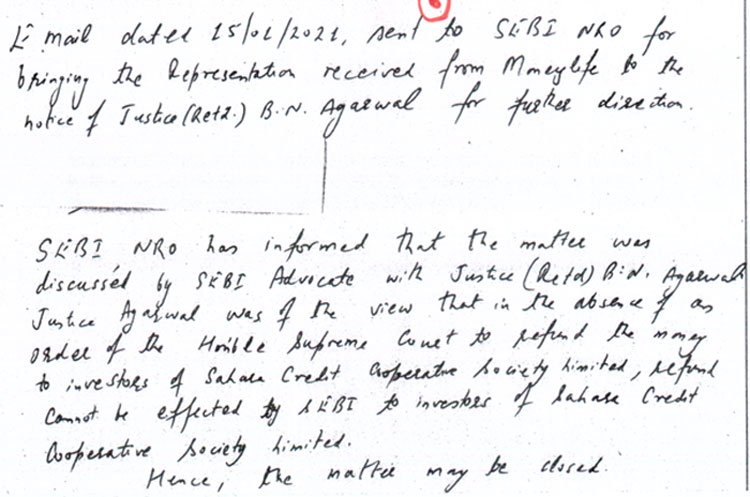

On 30 December 2020, Moneylife Foundation wrote to the SEBI chairman and justice BN Agrawal taking forward the facts stated by Vivek Aggarwal, the CRCS, in his letter dated 18 August 2020. The letter mentioned how Sahara Credit Cooperative Society Ltd (Sahara Credit), which has raised deposits of Rs47,245 crore, had provided an advance of Rs2,253 crore to Subrata Roy which was transferred to SEBI as money collected by the Sahara realty companies. Hence, at least this sum of Rs2,253 crore belongs to investors of Sahara Credit and they ought to be allowed to claim it. Moneylife Foundation had attached a list of 240 depositors of Sahara Credit who had provided complete documentation and requested the SEBI chairman and justice BN Agarwal to consider their claims, keeping in mind the spirit and essence of the SC judgement, and in view of the hardship they were suffering during the pandemic.

SEBI did not bother to acknowledge or respond to the letter. Former central information commissioner, Shailesh Gandhi and a colleague filed an application under the Right to Information (RTI) Act which was fobbed off saying that the appropriate regulator is the Credit Cooperative Societies under the ministry of agriculture and farmer’s welfare. Scores of investors writing to SEBI had received similar letters deflecting responsibility. On filing a first appeal under RTI, the public information officer was directed to provide information on our memorandum along with the file notings. The reply, dated 11th June (received 10 days later), said that our memorandum was referred to justice Agarwal who informed SEBI that the Supreme Court order “did not mention about refund of money to investors of Sahara Credit therefore the refunds cannot be effected by SEBI” to those investors. It further said, “As no further action was warranted, the matter was closed by SEBI.”

One expected SEBI to take a considered view of the matter and seek permission from the SC to expand the scope of refunds. But the regulator would rather sit on the money than exert itself to help investors. According to SEBI’s internal notes, contrary to Vivek Aggrawal’s claim, there is ‘no such amount’ of Rs2,253 crore deposited by Subrata Roy. But it admits that “Rs571.96 crore was credited by Sahara Credit” in SEBI’s refund account between 5 June 2014 and 13 June 2014 and has a list of the deposits. SEBI claims “it is not known in what capacity” the deposits were made, since there was no statement accompanying the credit.

While SEBI admits receiving at least Rs571.96 crore, it goes on to claim that Sahara’s counsel appearing before the SRCS on 19 November 2020 was unable to throw any light on the amount paid by Sahara Credit to SEBI. It also says it has now paid out Rs125.17 crore to bond-holders and some applications are pending completion of documents. In effect, Rs16 crore more has been paid out since the last statement to parliament—a drop in the ocean of the massive amounts held by SEBI.

SEBI’s negative-sounding note was placed before justice Agarwal. A hand-written note mentions that “Justice Agarwal was of the view that in the absence of an order of the honourable Supreme Court to refund the money to investors of Sahara Credit, refund cannot be effected by SEBI to investors. Hence the matter may be closed.”

There appears to be a slight but significant difference between what justice Agarwal said and SEBI’s interpretation. Justice Agarwal’s emphasis seems to be the absence of an SC order. The big question is: Who will approach the Supreme Court and apprise it about the new facts and developments? A regulator with empathy for investors would have gone back to the SC for a direction but SEBI clearly doesn’t care as is clear from the negative tone of its note.

Strangely enough, SEBI is working overtime to collect more money from a seemingly bankrupt group. As recently as in November 2020, SEBI filed a petition in the SC asking the Sahara group to deposit Rs62,600 crore, including interest on the Rs25,700 crore it was ordered to pay (Read: Pay Rs62,600 Crore To Stay out of Jail: SEBI to Saharasri Subrata Roy). It is doing this, knowing full well that there are no funds with Sahara, while investors are pleading to get their money back. Meanwhile, finance minister (FM) Nirmala Sitharaman’s reply to parliament on 15 March 2021 actually makes a very strong case for at least some of Sahara’s beleaguered investors.

Finance Minister’s Answer in Parliament

The FM’s written reply said that SFIO has found that Sahara Q Shop Unique Products Range Ltd’s investments were being converted into other schemes in Saharayan Universal Multipurpose Society Ltd, Sahara Credit Co-operative Societies and two other societies of the group. She also said that the government has received over 17,000 investor complaints against Sahara Q Shop and other group entities. She further revealed that SFIO found that deposits were collected “on false assurance, conversion of investments of Sahara Housing Corporation Ltd and Sahara India Real Estate Corporation Ltd into Sahara Q Shop and other Sahara group companies, and conversion of deposits from Sahara Q Shop to co-operative societies of Sahara Group. There are complaints alleging the conversion of investments of Sahara Housing Corporation Ltd and Sahara India Real Estate Corporation Ltd. The directors of these companies of Sahara have confirmed the conversions during the investigation by SFIO.” (emphasis added).

The minister further said that the “fund flow from the realty entities involved in the SEBI case to Sahara Q-shop had been established by SFIO.” This clearly makes a strong case for Q-shop and some of the cooperative societies to get their money back. The question is: Who will bell the cat? Will it be SEBI, whose primary job is to think about investors (according to the preamble to the SEBI Act)?

It was surely never the Supreme Court’s intention that SEBI will sit on the money. Moreover, the regulator is clearly out of ideas and it may be time for SC to set up a committee to collect all valid claims and distribute the money. The big difference today is that there are lakhs of genuine investors who have been duped—unlike in the past when it was impossible to find a Sahara investor.

An even bigger mystery is the lack of action against the Subrata Roy and family, many of who are citizens of the Republic of Macedonia and have also duped that nation with false promises (A Son of Indian Billionaire ‘Resides’ in a Modest Post-Communist Building in Macedonia).The bigger question is: Why are some bad-boy billionaires treated differently from others? Why are Subrata Roy, the Sandesara family, Siva Sankaran, Venugopal Dhoot and Anil Ambani given the kid-glove treatment?

First published by Moneylife.